Porsche AG is prioritizing long-term growth through bold investments in electrification, software, and organizational restructuring, even as it accepts a short-term financial hit.

In the first quarter of 2025, the company committed to an additional €1.3 billion in strategic spending—up from an earlier estimate of €800 million—mainly targeting product development, battery activities, and internal realignments.

READ MORE: Lexus Reaches 100,000 Plug-In Hybrids on Roads Worldwide

Financial Performance Impacted by Strategic Investments

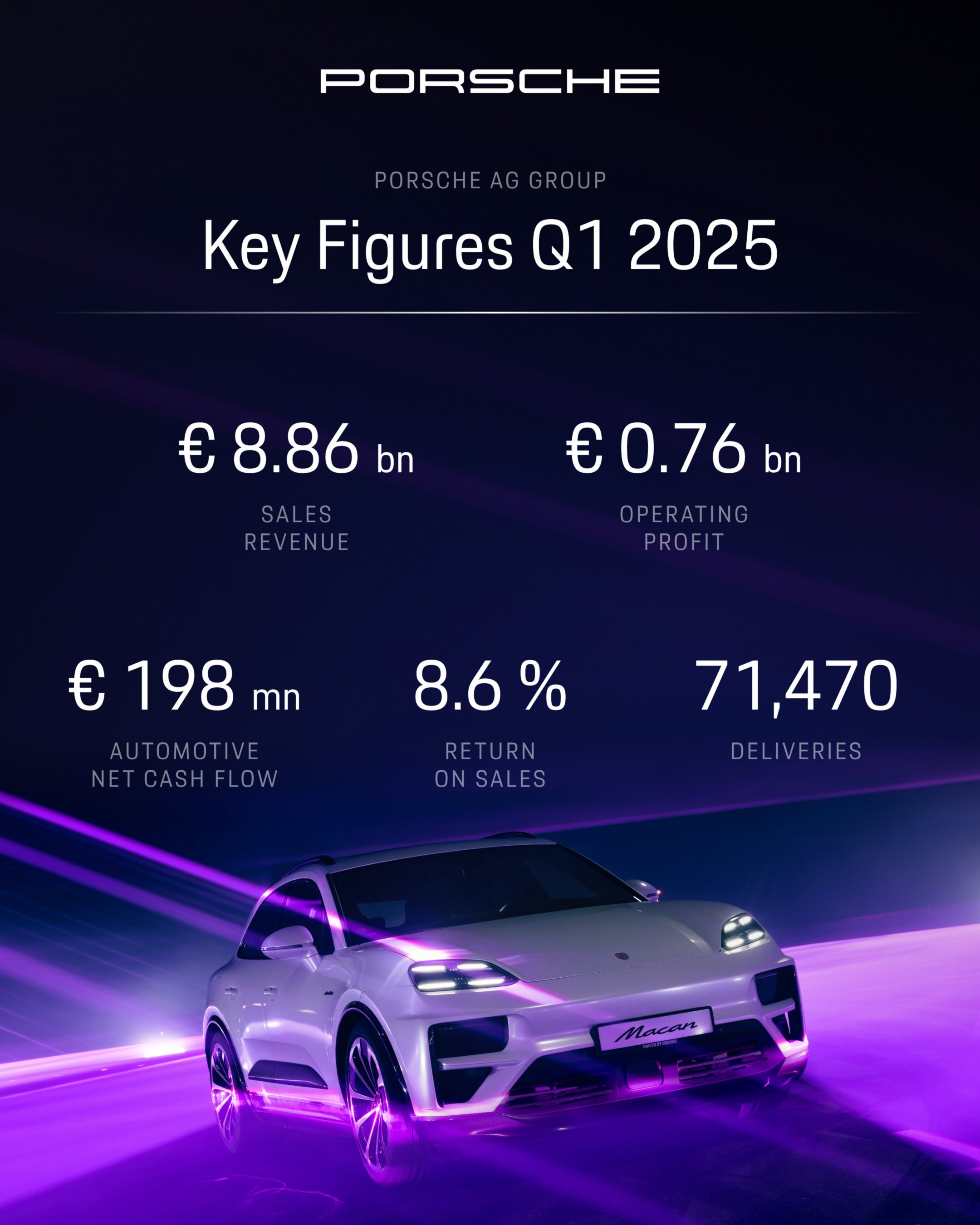

Revenue for Q1 2025 dipped 1.7% to €8.86 billion, while operating profit dropped sharply by 40.6% to €760 million. The operating return on sales slid to 8.6%, down from 14.2% in Q1 2024. Despite the profit squeeze, automotive net cash flow increased to €198 million, up from €107 million, reflecting improved liquidity and operational cash handling.

According to CFO Dr. Jochen Breckner, the short-term strain is a necessary step: “We are investing decisively in the future of Porsche – in products, software and measures that will strengthen us in the long term.”

Electrification Strategy and Product Adjustments

Porsche reported a notable uptick in electrified vehicle deliveries, with 39% of cars sold in Q1 2025 being electrified—26% fully electric (BEVs) and 13% plug-in hybrids (PHEVs).

The electric Macan played a central role, contributing 14,185 BEV deliveries out of 23,555 total Macans, a 14% increase year-on-year. The Panamera also surged ahead with a 27% rise in deliveries, totaling 7,769 units.

However, the company has revised its battery strategy. Plans for independent expansion by Cellforce Group GmbH—a Porsche subsidiary—have been shelved, signaling a strategic pivot in the face of electromobility’s slower-than-expected ramp-up and weaker BEV demand in key markets like China.

Porsche also invested in V4Smart GmbH & Co. KG and deepened its involvement with VARTA AG, underscoring a shift toward high-performance lithium-ion battery cell production partnerships rather than in-house scale-up.

Global Market Performance and Strategic Challenges

Sales performance remained mixed. Deliveries in North America surged 37%, thanks in part to last year’s logistical delays, while China saw a 42% decline due to sustained economic pressures and intense competition in the high-end EV segment.

Porsche continues to lean on its “value over volume” strategy, maintaining a globally balanced sales structure rather than chasing unit growth at the expense of brand equity.

The company also cited geopolitical pressures, rising supplier costs, and the introduction of U.S. import tariffs (affecting results from April and May) as contributing to a more subdued financial outlook.

Adjusted 2025 Forecast

Due to the impact of these special expenses and market realities, Porsche revised its full-year 2025 forecast:

- Sales revenue: €37–38 billion (down from €39–40 billion)

- Return on sales: 6.5%–8.5% (was 10%–12%)

- Net cash flow margin: 4%–6% (was 7%–9%)

- Automotive EBITDA margin: 16.5%–18.5% (was 19%–21%)

- BEV share: unchanged at 20%–22%

Looking Ahead

Porsche is betting big on software and electrification, despite short-term financial pressures and changing global conditions. The company is positioning itself for long-term resilience by adapting its product portfolio, corporate structure, and supplier strategies, especially in response to complex China dynamics and EV market shifts.

While profitability and growth metrics may be lower this year, Porsche sees these moves as essential steps toward safeguarding its innovation leadership in a fast-evolving automotive landscape.

READ MORE: Opel Launches New Frontera SUV with Comic-Inspired Campaign

Subscribe today for the freshest car news delivered to your inbox