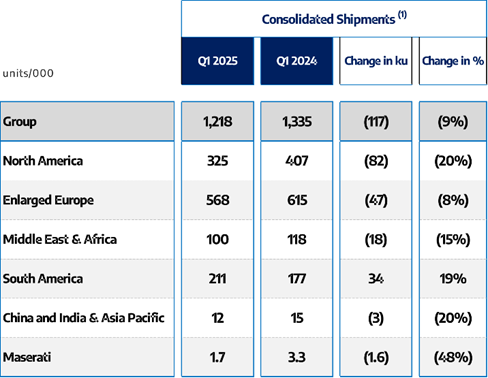

Stellantis has reported a mixed start to 2025, with global shipments for Q1 reaching around 1.2 million units, a 9% drop year-over-year.

The decline mainly stems from lower production volumes in North America due to extended holiday downtime in January and transition-related slowdowns in Europe, where older models were phased out at the end of 2024.

In North America, shipments fell by approximately 82,000 units, down 20% compared to Q1 2024. This drop is attributed to both the January production lull and the gradual rollout of the updated 2025 Ram 2500 and 3500 heavy-duty trucks.

READ MORE: Stellantis and Qinomic Launch Retrofit Solution to Electrify Light Commercial Vehicles

Despite this, sales of Jeep Compass, Grand Cherokee, and Ram 1500/2500 were all up over 10% year-on-year. Importantly, March retail orders hit their highest point since mid-2023, pointing to recovering consumer demand.

Europe saw shipments decline by about 47,000 units, down 8% from Q1 last year. Two-thirds of this drop was due to delays in replacing discontinued A and B-segment vehicles, while the rest came from weaker light commercial vehicle (LCV) sales.

However, Stellantis gained ground in the EU30, with Q1 market share rising to 17.3%, up 1.9 points from Q4 2024—boosted by the launch of new models like the Citroën C3 Aircross, Opel Frontera, and Fiat Grande Panda.

Performance in Stellantis’ so-called “Third Engine” markets—South America, Middle East & Africa, and China & India Asia Pacific—was more positive, with a collective shipment increase of 13,000 units (+4% year-on-year).

Growth was led by South America, which jumped 19%, particularly in Brazil and Argentina, offsetting declines in the Middle East & Africa due to import restrictions in Algeria, Tunisia, and Egypt.

While these Q1 shipment estimates are still unaudited and may be revised in Stellantis‘ final revenue report, the data underscores a tentative rebound in several key areas, driven by new product launches and stronger order activity, even as the company works through regional disruptions and model transition periods.

READ MORE: New Over-the-Air Update Adds Enhanced Navigation with Electric Intelligence and Offroad Track Mode

Subscribe today for the freshest car news delivered to your inbox